Welcome to Our Medtech Talk Podcast Channel

Too often we define the Medtech sector by the number of dollars raised, IPOs helped or companies sold. But the focus neglects the very foundation of the sector - the People. Join the Medtech Talk Podcast each week to hear from entrepreneurs, investors and executives who spend their days developing the tools that make sick people well and health care more efficient.

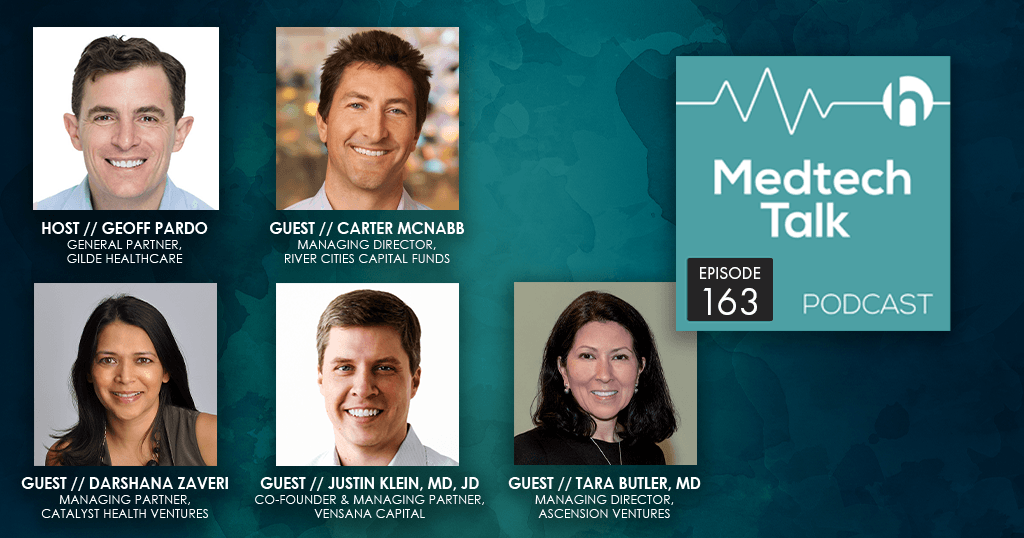

The pandemic has certainly affected many aspects of life, but what about the medtech industry? Specifically for this audience, did COVID impact medtech investment strategy? As part of the recent Medtech MVP conference, host Geoff Pardo moderated a panel interview with four medtech investors to tackle that question and many more: Carter McNabb, Managing Director, River Cities Capital Funds; Darshana Zaveri, Managing Partner, Catalyst Health Ventures; Justin Klein, MD, JD, Co-Founder & Managing Partner, Vensana Capital; and Tara Butler, MD, Managing Director, Ascension Ventures. The panel also discussed aspects of the virtual world that are likely to remain in the entrepreneur/VC ecosystem, the latest drama around coverage and MCIT, the rise of consumerism and patient payment, the funding gap for early-stage companies, and the investment appetite for AI/data-driven diagnostics and devices. Listen now to catch these valuable insights!

Carter McNabb

Carter joined River Cities in 1999 and leads the Firm’s healthcare investing practice. He has been instrumental in setting River Cities’ healthcare strategy and establishing the Firm’s credibility within

the healthcare vertical. Previously, Carter worked in marketing and business development for Home Technology Healthcare, a comprehensive home healthcare company offering nursing, DME, infusion therapy and hospice services. Home Technology Healthcare

was private equity financed by Continental Illinois and acquired by Integrated Health Services in 1997. As the 1998 recipient of the Bradford Fellowship for achievements in corporate finance, Carter worked in equity research at J.C. Bradford &

Co. while attending business school at Vanderbilt. Carter has achieved numerous highly profitable exits in healthcare services and medical technology, including Suros Surgical Systems, Accelecare, SurgiQuest, OrthoHelix, Invivodata, PerfectServe,

TissueTech and Orthoscan. He currently serves on the boards of Nico, OrthAlign, Bolder Surgical, Spineology and Catalyst Orthoscience. Carter is also an independent board member of UC Health. Carter holds a BA in Classical Studies from Trinity College

(Hartford, CT) where he was awarded the James Goodwin Prize, the oldest academic honor at the college, and received his MBA from Vanderbilt University.

Darshana Zaveri

Darshana Zaveri is a Managing Partner of Catalyst Health Ventures. Darshana is actively involved in all aspects of Fund Management including Investments and Capital Raising. She led Catalyst’s investments in Augmenix

Inc. (Acquired by Boston Scientific, NYSE: BSX), nVision Medical (Acquired by Boston Scientific, NYSE: BSX), Maxwell Health (Acquired by Sun Life Financial, NYSE: SLF), Aria CV, Atacor Medical, Panther Therapeutix and Instylla Inc. She was also actively

involved with portfolio company Allegro Diagnostics, Inc. (acquired by Veracyte, NASDAQ: VCT). She serves on the Boards of Directors of all the currently active CHV portfolio companies listed above and serves as Chair of the Board of Aria CV. Darshana

brings to Catalyst over a decade of experience in the health care and Life Science Industries. Prior to Catalyst, she was an Investigator at Vertex Pharmaceuticals and an integral part of the drug development programs in oncology, metabolic disease,

and immunology. Previously she worked at Genome Therapeutics, a Massachusetts-based biotechnology company, at the Dana Farber Cancer Institute and completed an internship at the United Nations. She has authored several publications and scientific

journal articles. She currently serves as a Catalyst of the Deshpande Center for Technological Innovation at the Massachusetts Institute of Technology, as a Board Director of Tie Boston (The Indus Valley Entrepreneurs) and as a lead advisor to the

Portfolia FemTech fund. Darshana received an MPA from Harvard University, a Masters in Cell and Molecular Biology from Boston University, and a BS in Biochemistry from Bombay University in Bombay, India.

Justin Klein

Justin Klein, MD, JD, is a co-founder and Managing Partner at Vensana Capital, a venture capital & growth equity investment firm dedicated to partnering with entrepreneurs who seek to transform healthcare with breakthrough

innovations in medical technology. Justin was previously a partner at NEA, one of the largest and most active venture capital firms in the world. Justin also worked at the Duke University Health System where his experience included roles in strategy,

finance and operations as Duke built one of the nation’s first integrated healthcare delivery systems. Justin currently or previously served on the board of directors of Cartiva (acquired), ChromaCode, CV Ingenuity (acquired), Epix Therapeutics

(acquired), FIRE1, Intact Vascular, Metavention, Personal Genome Diagnostics, PhaseBio Pharmaceuticals (IPO), Relievant MedSystems, Senseonics (IPO), Topera (acquired), Ulthera (acquired), VertiFlex, Vesper Medical, and VytronUS. Justin graduated

with an AB in Economics, a BS in Biological Anthropology & Anatomy, and a Minor in Chemistry from Duke University. He also concurrently earned his MD from the Duke University School of Medicine and his JD from Harvard Law School.

Tara Butler

Tara Butler joined Ascension Ventures in 2002. She primarily focuses on investments in the medical device and diagnostics sector. Tara has been a board member or observer at several Ascension Ventures portfolio companies, including

Apama Medical, Augmenix, Cardionomics, CHF Solutions, Confluent Surgical, CSA Medical, EBR Systems, HemoSphere, Imperative Care, Instylla, Interventional Spine, ISTO Technologies, Ivantis, MindFrame, Neurolutions, Novasys, Ocular Therapeutix (NASDQ:OCUL),

OptiScan Biomedical, PathoGenetix, Renovia, Stereotaxis (NASD:STXS) and TomoTherapy (NASD:TOMO). Before joining AV she completed a residency in Obstetrics and Gynecology at the Washington University School of Medicine. Prior to that, Tara held positions

in business development at Medtronic, in finance at Honeywell, as a laboratory research assistant at the University of Pennsylvania School of Medicine. She holds a BS in Economics and an MBA from the Wharton School of Business at the University of

Pennsylvania, and a Doctor of Medicine from the University of Pennsylvania School of Medicine.